데이터 사이언스 07 시계열 데이터 02-주가예측-prophet

1. 주가예측 - statsmodels

1) 모듈명 변경 및 설치

- 과거 pandas.io.data 모듈이

pandas_datareader.data로 바뀜 - 모듈 설치

➜ pip install pandas-datareader

Collecting pandas-datareader

Downloading pandas_datareader-0.5.0-py2.py3-none-any.whl (74kB)

100% |████████████████████████████████| 81kB 606kB/s

Installing collected packages: requests-ftp, requests-file, pandas-datareader

Running setup.py install for requests-ftp ... done

Successfully installed pandas-datareader-0.5.0 requests-file-1.4.3 requests-ftp-0.3.1

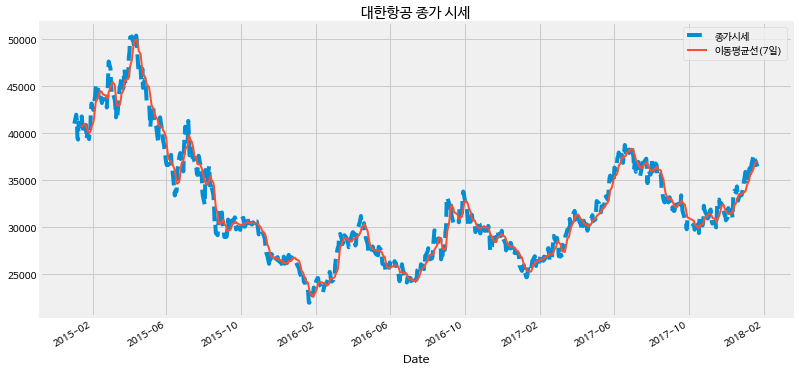

2) 대한항공 주가

- 종목 코드 : 003490

- 2015년 1월 1일부터 현재까지의 주가

import warnings

warnings.filterwarnings("ignore")

import itertools

import pandas as pd

import numpy as np

import statsmodels.api as sm

import matplotlib.pyplot as plt

plt.style.use('fivethirtyeight')

%matplotlib inline

# 한글폰트

import matplotlib.font_manager as fm

# 폰트 적용

font_location = '/usr/share/fonts/truetype/nanum/NanumBarunGothic.ttf'

font_name = fm.FontProperties(fname=font_location).get_name()

from matplotlib import rc

rc('font', family=font_name)

import pandas_datareader.data as web

from datetime import datetime

# 대한항공 2015. 1. 1.부터 현재까지의 주가

start = datetime( 2015, 1, 1 )

end = datetime.now()

# yahoo 파이낸스

KA = web.DataReader('003490.KS', 'yahoo', start, end)

KA.head()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2015-01-02 | 43374.101563 | 44282.398438 | 40966.898438 | 41012.300781 | 41012.300781 | 1062595 |

| 2015-01-05 | 41330.300781 | 42329.500000 | 40194.800781 | 41966.101563 | 41966.101563 | 912246 |

| 2015-01-06 | 42374.898438 | 43192.398438 | 41466.500000 | 41466.500000 | 41466.500000 | 948055 |

| 2015-01-07 | 39059.398438 | 40558.199219 | 37197.199219 | 39513.601563 | 39513.601563 | 3256086 |

| 2015-01-08 | 39604.398438 | 40240.199219 | 38605.199219 | 39331.898438 | 39331.898438 | 549048 |

KA['Close'].plot(

style='--',

figsize=(12, 6)

)

pd.rolling_mean( KA['Close'], 7).plot( lw=2 )

plt.title('대한항공 종가 시세')

plt.legend( ['종가시세', '이동평균선(7일)' ] )

plt.show()

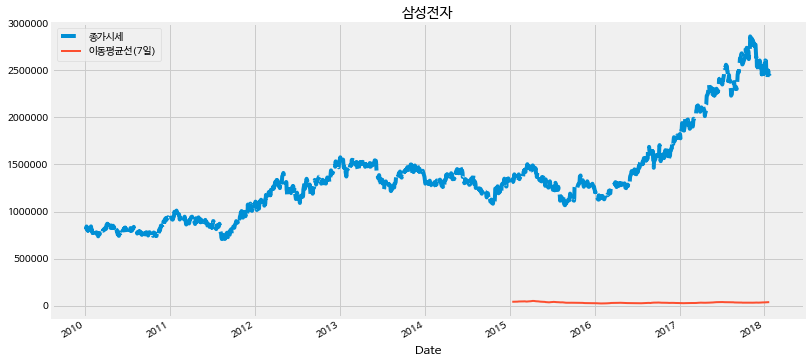

3) 삼성전자 주가

- 종목 코드: 005930

start = datetime( 2010, 1, 1 )

end = datetime.now()

SamSung = web.DataReader('005930.KS', 'yahoo', start, end)

SamSung['Close'].plot(

style='--',

figsize=(12, 6)

)

pd.rolling_mean( KA['Close'], 7).plot( lw=2 )

plt.title('삼성전자')

plt.legend( ['종가시세', '이동평균선(7일)' ] )

plt.show()

SamSung.head(3)

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2010-01-04 | 803000.0 | 809000.0 | 800000.0 | 809000.0 | 740499.0625 | 239016 |

| 2010-01-05 | 826000.0 | 829000.0 | 815000.0 | 822000.0 | 752398.2500 | 558517 |

| 2010-01-06 | 829000.0 | 841000.0 | 826000.0 | 841000.0 | 769789.5000 | 458977 |

len(SamSung)

1991

from pylab import rcParams

rcParams['figure.figsize'] = 12, 8

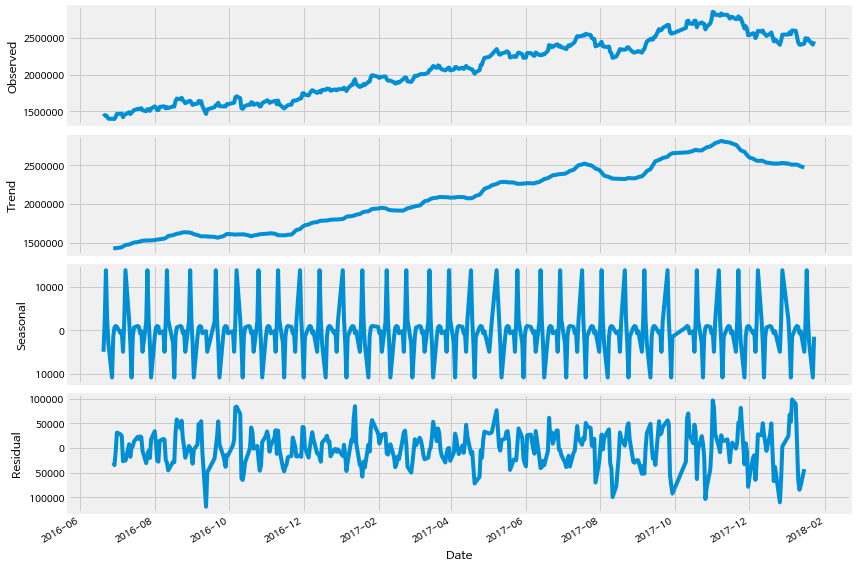

# 삼성전자 주식 종가에 대한 분해

y = SamSung['Close'][ 1600 : ]

decomposition = sm.tsa.seasonal_decompose( y, freq=12 )

fig = decomposition.plot()

plt.show()

# Define the p, d and q parameters to take any value between 0 and 2

p = d = q = range(0, 2)

# Generate all different combinations of p, q and d triplets

pdq = list( itertools.product(p, d, q))

# Generate all different combinations of seasonal p, q and d triplets

seasonal_pdq = [ (x[0], x[1], x[2], 12) for x in pdq ]

print('Example of parameter combinations for Seasonal ARIMA ...')

print('SARIMAX: {} x {}'.format(pdq[1], seasonal_pdq[1]) )

print('SARIMAX: {} x {}'.format(pdq[1], seasonal_pdq[2]) )

print('SARIMAX: {} x {}'.format(pdq[2], seasonal_pdq[3]) )

print('SARIMAX: {} x {}'.format(pdq[2], seasonal_pdq[4]) )

Example of parameter combinations for Seasonal ARIMA ...

SARIMAX: (0, 0, 1) x (0, 0, 1, 12)

SARIMAX: (0, 0, 1) x (0, 1, 0, 12)

SARIMAX: (0, 1, 0) x (0, 1, 1, 12)

SARIMAX: (0, 1, 0) x (1, 0, 0, 12)

warnings.filterwarnings("ignore")

y = SamSung['Close']

select_candi = 10000000

param_candi = ( 0, 0, 0 )

param_seasonal_candi = ( 0, 0, 0)

count=0

end_count = len(pdq)

for param in pdq:

for param_seasonal in seasonal_pdq:

try:

mod = sm.tsa.statespace.SARIMAX(

y,

order=param,

seasonal_order=param_seasonal,

enforce_stationarity=False,

enforce_invertibility=False

)

results = mod.fit()

count += 1

if count <= 5:

print('ARIMA{}x{}12 - AIC:{}'.format(param, param_seasonal, results.aic))

if results.aic < select_candi:

select_candi = results.aic

param_candi = param

param_seasonal_candi = param_seasonal

except:

continue

print(param_candi, param_seasonal_candi, select_candi)

ARIMA(0, 0, 0)x(0, 0, 1, 12)12 - AIC:60253.297878071855

ARIMA(0, 0, 0)x(0, 1, 1, 12)12 - AIC:49644.270908598235

ARIMA(0, 0, 0)x(1, 0, 0, 12)12 - AIC:49928.79116493459

ARIMA(0, 0, 0)x(1, 0, 1, 12)12 - AIC:49903.76087716084

ARIMA(0, 0, 0)x(1, 1, 0, 12)12 - AIC:49669.749916549496

(1, 1, 1) (0, 0, 1, 12) 45391.1132768003

mod = sm.tsa.statespace.SARIMAX(

y,

order=(1, 1, 1),

seasonal_order=(0, 0, 1, 12),

enforce_stationarity=False,

enforce_invertibility=False

)

results = mod.fit()

print( results.summary().tables[1] )

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 -0.6241 0.182 -3.431 0.001 -0.981 -0.268

ma.L1 0.6733 0.172 3.925 0.000 0.337 1.010

ma.S.L12 0.0194 0.019 0.997 0.319 -0.019 0.058

sigma2 5.519e+08 5.22e-11 1.06e+19 0.000 5.52e+08 5.52e+08

==============================================================================

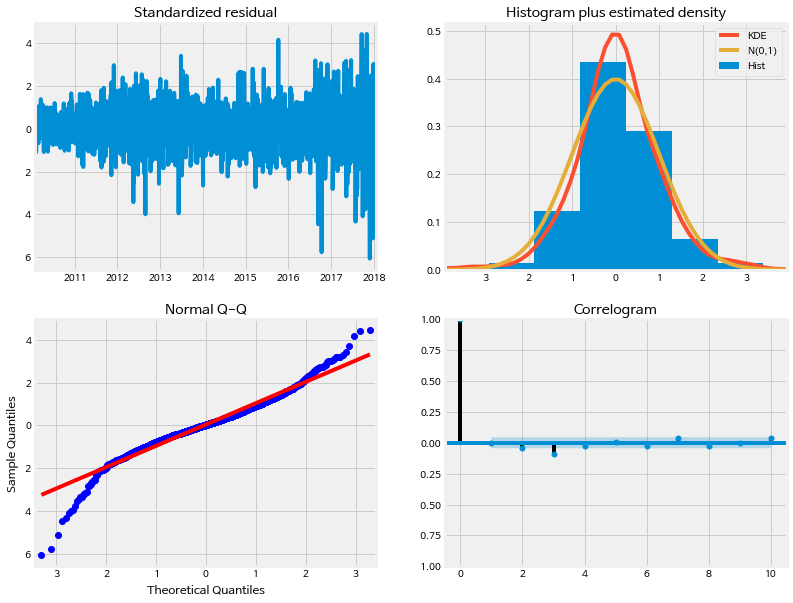

results.plot_diagnostics( figsize=(12, 10) )

plt.show()

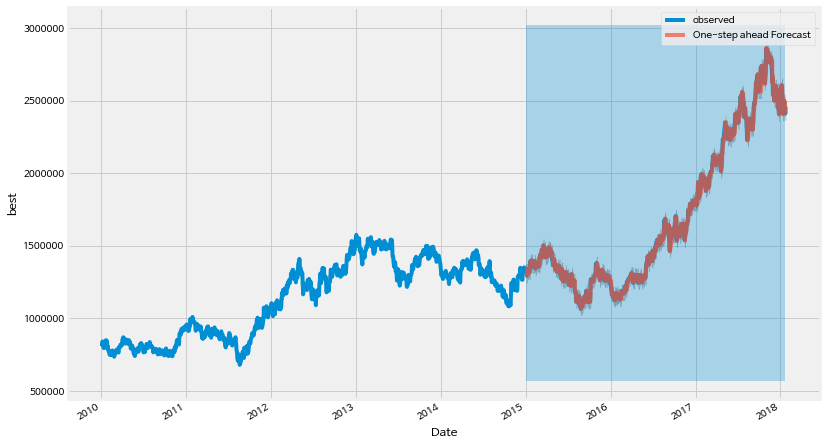

pred = results.get_prediction(

start=pd.to_datetime('2015-1-2'),

dynamic=False

)

pred_ci = pred.conf_int()

# 관측 데이터 1973년 부터 끝까지

ax = y[ '2000' : ].plot( label='observed', figsize=(12, 8) )

# 예측

pred.predicted_mean.plot(

ax=ax,

label='One-step ahead Forecast',

alpha=.7

)

ax.fill_between(

pred_ci.index,

pred_ci.iloc[ : , 0 ],

pred_ci.iloc[ : , 1 ],

color='k',

alpha=.2

)

ax.fill_betweenx(

ax.get_ylim(),

pd.to_datetime('2015-01-01'),

y.index[-1],

alpha=.3,

)

ax.set_xlabel('Date')

ax.set_ylabel('best')

plt.legend()

plt.show()

y = SamSung['Close'].resample('MS').mean()

warnings.filterwarnings("ignore")

select_candi = 10000000

param_candi = ( 0, 0, 0 )

param_seasonal_candi = ( 0, 0, 0)

count=0

end_count = len(pdq)

for param in pdq:

for param_seasonal in seasonal_pdq:

try:

mod = sm.tsa.statespace.SARIMAX(

y,

order=param,

seasonal_order=param_seasonal,

enforce_stationarity=False,

enforce_invertibility=False

)

results = mod.fit()

count += 1

if count <= 5:

print('ARIMA{}x{}12 - AIC:{}'.format(param, param_seasonal, results.aic))

if results.aic < select_candi:

select_candi = results.aic

param_candi = param

param_seasonal_candi = param_seasonal

except:

continue

print(param_candi, param_seasonal_candi, select_candi)

ARIMA(0, 0, 0)x(0, 0, 1, 12)12 - AIC:2588.3600182104815

ARIMA(0, 0, 0)x(0, 1, 1, 12)12 - AIC:2077.9442515545934

ARIMA(0, 0, 0)x(1, 0, 0, 12)12 - AIC:2411.5750802284015

ARIMA(0, 0, 0)x(1, 0, 1, 12)12 - AIC:2388.3744838038806

ARIMA(0, 0, 0)x(1, 1, 0, 12)12 - AIC:2100.2859990842962

(0, 1, 1) (1, 1, 1, 12) 1798.848144371688

mod = sm.tsa.statespace.SARIMAX(

y,

order=( 0, 1, 1 ),

seasonal_order=( 1, 1, 1, 12 ),

enforce_stationarity=False,

enforce_invertibility=False

)

results = mod.fit()

print( results.summary().tables[1] )

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ma.L1 0.2222 0.243 0.916 0.360 -0.253 0.698

ar.S.L12 -0.8107 0.208 -3.888 0.000 -1.219 -0.402

ma.S.L12 -0.0022 0.278 -0.008 0.994 -0.546 0.542

sigma2 1.145e+10 7.04e-12 1.63e+21 0.000 1.15e+10 1.15e+10

==============================================================================

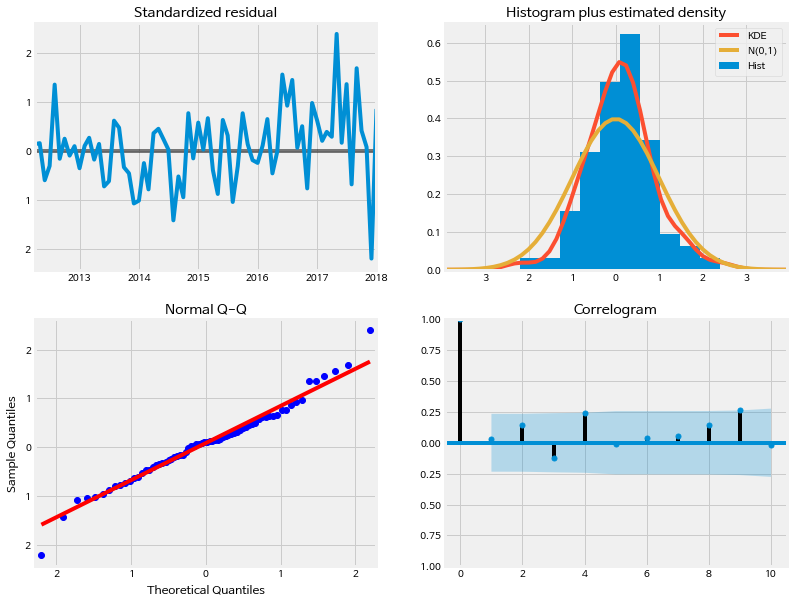

results.plot_diagnostics( figsize=(12, 10) )

plt.show()

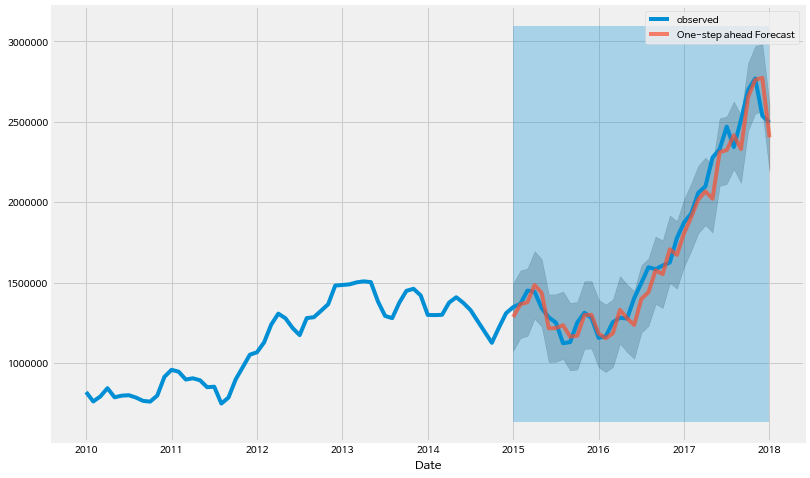

pred = results.get_prediction(

start=pd.to_datetime('2015-01-01'),

dynamic=False

)

pred_ci = pred.conf_int()

# 관측 데이터 2003년 부터 끝까지

ax = y[ '2003' : ].plot( label='observed', figsize=(12, 8) )

# 예측

pred.predicted_mean.plot(

ax=ax,

label='One-step ahead Forecast',

alpha=.7

)

ax.fill_between(

pred_ci.index,

pred_ci.iloc[ : , 0 ],

pred_ci.iloc[ : , 1 ],

color='k',

alpha=.2

)

ax.fill_betweenx(

ax.get_ylim(),

pd.to_datetime('2015-01-01'),

y.index[-1],

alpha=.3,

)

ax.set_xlabel('Date')

plt.legend()

plt.show()

2. 주가예측 - Prophet

https://facebook.github.io/prophet/

https://github.com/facebook/prophet

1) install

- Ubuntu16.04LTS, Python 3.6.2 환경

- 패키지로 설치하는 것이 편하고 안전하다.

➜ pip install fbprophet

Collecting fbprophet

Downloading fbprophet-0.2.1.tar.gz

Collecting pystan>=2.14 (from fbprophet)

Downloading pystan-2.17.1.0-cp36-cp36m-manylinux1_x86_64.whl (68.1MB)

100% |████████████████████████████████| 68.1MB

Downloading Cython-0.27.3-cp36-cp36m-manylinux1_x86_64.whl (3.1MB)

100% |████████████████████████████████| 3.1MB 236kB/s

Installing collected packages: Cython, pystan, fbprophet

Running setup.py install for fbprophet ... \

2) 기아자동차 주식

import warnings

warnings.filterwarnings("ignore")

import itertools

import pandas as pd

import numpy as np

import statsmodels.api as sm

import matplotlib.pyplot as plt

plt.style.use('fivethirtyeight')

%matplotlib inline

import pandas_datareader.data as web

from datetime import datetime

# 한글폰트

import matplotlib.font_manager as fm

# 폰트 적용

font_location = '/usr/share/fonts/truetype/nanum/NanumBarunGothic.ttf'

font_name = fm.FontProperties(fname=font_location).get_name()

from matplotlib import rc

rc('font', family=font_name)

from fbprophet import Prophet

start = datetime( 1990, 1, 1 )

end = datetime( 2017, 6, 30 )

# 기아자동차 주식

KIA = web.DataReader('000270.KS', 'yahoo', start, end )

KIA.head()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2000-01-04 | 7404.520020 | 7665.240234 | 7300.229980 | 7665.240234 | 6111.007324 | 636300.0 |

| 2000-01-05 | 7404.520020 | 7404.520020 | 7248.089844 | 7248.089844 | 5778.440918 | 686100.0 |

| 2000-01-06 | 7331.520020 | 7519.240234 | 6935.220215 | 6935.220215 | 5529.009277 | 379000.0 |

| 2000-01-07 | 6987.359863 | 7143.799805 | 6778.790039 | 6778.790039 | 5404.296875 | 701400.0 |

| 2000-01-10 | 6841.359863 | 7102.080078 | 6810.069824 | 7091.649902 | 5653.720703 | 1076700.0 |

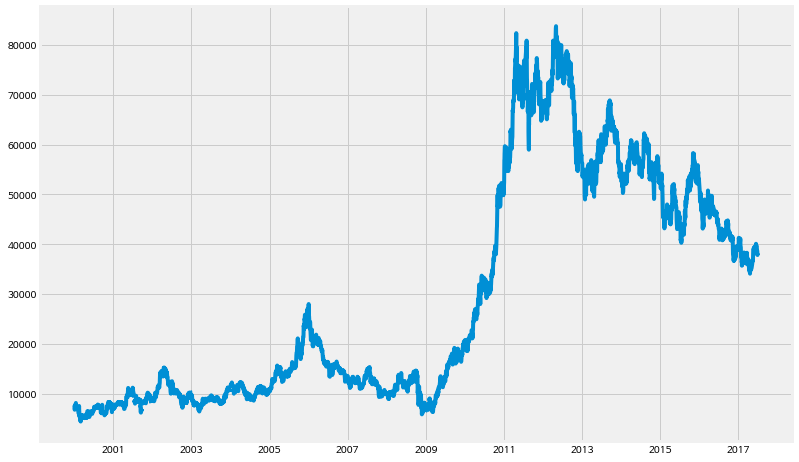

KIA['Close'].plot()

<matplotlib.axes._subplots.AxesSubplot at 0x7f1f1d6a3160>

# 2016-12-31까지

KIA_trunc = KIA[ : '2016-12-31' ]

KIA_trunc.head(3)

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2000-01-04 | 7404.52002 | 7665.240234 | 7300.229980 | 7665.240234 | 6111.007324 | 636300.0 |

| 2000-01-05 | 7404.52002 | 7404.520020 | 7248.089844 | 7248.089844 | 5778.440918 | 686100.0 |

| 2000-01-06 | 7331.52002 | 7519.240234 | 6935.220215 | 6935.220215 | 5529.009277 | 379000.0 |

df = pd.DataFrame(

{

'ds': KIA_trunc.index,

'y' : KIA_trunc['Close']

}

)

df.reset_index( inplace=True )

del df['Date']

df.head(3)

| ds | y | |

|---|---|---|

| 0 | 2000-01-04 | 7665.240234 |

| 1 | 2000-01-05 | 7248.089844 |

| 2 | 2000-01-06 | 6935.220215 |

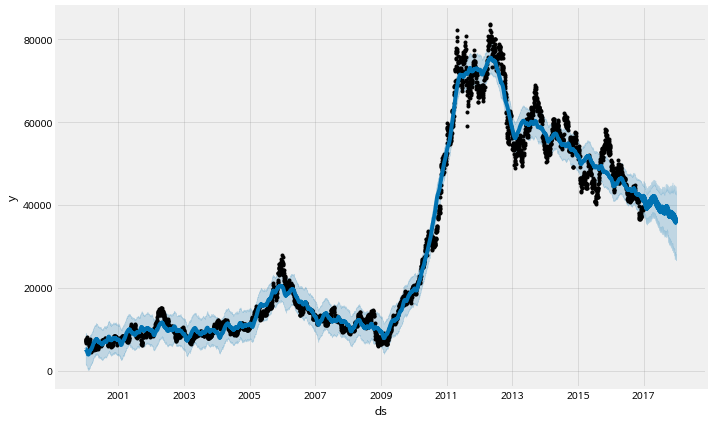

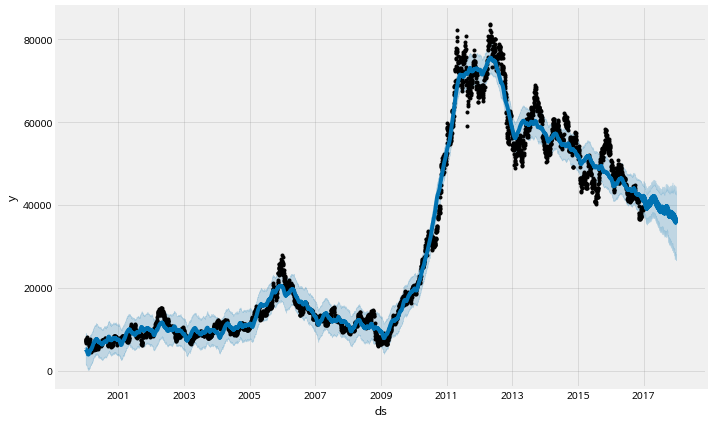

m = Prophet()

m.fit(df)

<fbprophet.forecaster.Prophet at 0x7f1f1cb3a7f0>

future = m.make_future_dataframe( periods=365 )

future.tail(3)

| ds | |

|---|---|

| 4663 | 2017-12-27 |

| 4664 | 2017-12-28 |

| 4665 | 2017-12-29 |

forecast = m.predict( future )

forecast[ [ 'ds', 'yhat', 'yhat_lower', 'yhat_upper' ] ].tail()

| ds | yhat | yhat_lower | yhat_upper | |

|---|---|---|---|---|

| 4661 | 2017-12-25 | 35736.021198 | 26901.256042 | 43506.681983 |

| 4662 | 2017-12-26 | 35781.066339 | 26897.317236 | 42529.643307 |

| 4663 | 2017-12-27 | 35749.136369 | 26619.638417 | 43537.664311 |

| 4664 | 2017-12-28 | 35714.091179 | 26785.438078 | 43183.694451 |

| 4665 | 2017-12-29 | 35650.791639 | 26849.725225 | 43201.114843 |

plt.figure( figsize=( 12, 8) )

plt.plot( KIA['Close'] )

plt.show()

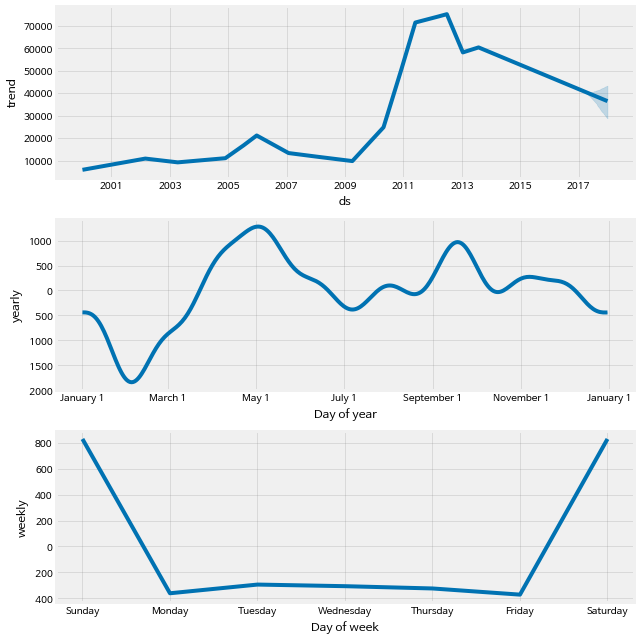

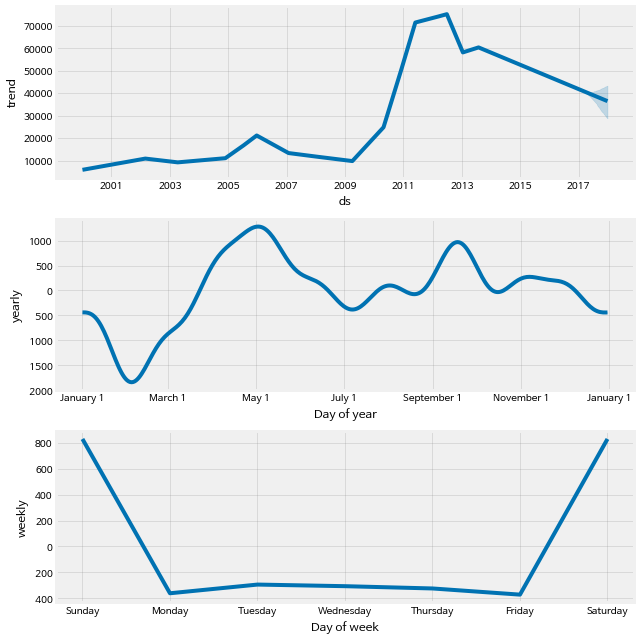

m.plot(forecast)

m.plot_components( forecast )

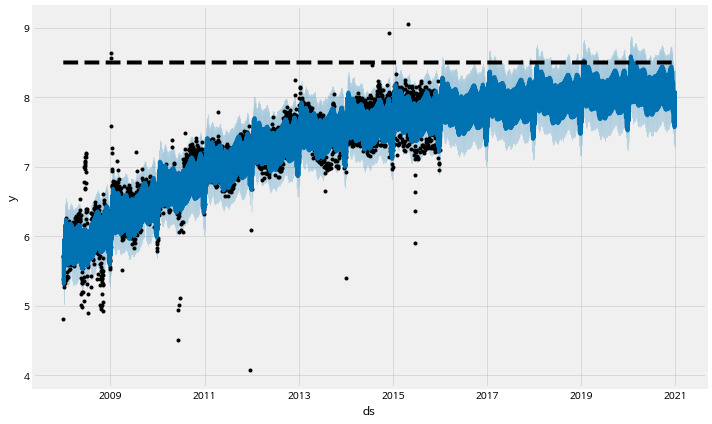

3) 기아자동차 주식 - Growth Model

df = pd.read_csv( './data_science/07. example_wp_R.csv' )

df['y' ] = np.log( df['y'] )

df['cap'] = 8.5

m = Prophet( growth='logistic' )

m.fit(df)

<fbprophet.forecaster.Prophet at 0x7f1f271417f0>

future = m.make_future_dataframe( periods=1826 )

future['cap'] = 8.5

fcst = m.predict( future )

m.plot( fcst )